Building Character – Balancing a Home’s Personality and Amenities

It’s sometimes said that the limitations of a house are what help make it a home. For many, however, it is a point of pride to accept only the finest in their new residence. How can you find the balance between cultivating a lived-in home with personality and quirks versus a house with cutting-edge amenities that improve quality of life? To get to the bottom of that, we gathered a list of the six keys to consider when selecting and developing the home of your dreams:

The neighborhood

Surprisingly, one of the biggest factors in choosing a new home isn’t the property itself, but rather the surrounding neighborhood. While new homes occasionally spring up in established communities, most are built in new developments. The settings are quite different, each with their own unique benefits.

Older neighborhoods often feature tree-lined streets; larger property lots; a wide array of architectural styles; easy walking access to mass transportation, restaurants and local shops; and more established relationships among neighbors.

New developments are better known for wider streets and quiet cul-de-sacs; controlled development; fewer aboveground utilities; more parks; and often newer public facilities (schools, libraries, pools, etc.). There are typically more children in newer communities, as well.

Consider your daily work commute, too. While not always true, older neighborhoods tend to be closer to major employment centers, mass transportation and multiple car routes (neighborhood arterials, highways and freeways).

Design and layout

If you like Victorian, Craftsman or Cape Cod style homes, it used to be that you would have to buy an older home from the appropriate era. But with new-home builders now offering modern takes on those classic designs, that’s no longer the case. There are even modern log homes available.

Have you given much thought to your floor plans? If you have your heart set on a family room, an entertainment kitchen, a home office and walk-in closets, you’ll likely want to buy a newer home—or plan to do some heavy remodeling of an older home. Unless they’ve already been remodeled, most older homes feature more basic layouts.

If you have a specific home-décor style in mind, you’ll want to take that into consideration, as well. Professional designers say it’s best if the style and era of your furnishings match the style and era of your house. But if you are willing to adapt, then the options are wide open.

Materials and craftsmanship

Homes built before material and labor costs spiked in the late 1950s have a reputation for higher-grade lumber and old-world craftsmanship (hardwood floors, old-growth timber supports, ornate siding, artistic molding, etc.).

However, newer homes have the benefit of modern materials and more advanced building codes (copper or polyurethane plumbing, better insulation, double-pane windows, modern electrical wiring, earthquake/ windstorm supports, etc.).

Current condition

The condition of a home for sale is always a top consideration for any buyer. However, age is a factor here, as well. For example, if the exterior of a newer home needs repainting, it’s a relatively easy task to determine the cost. But if it’s a home built before the 1970s, you have to also consider the fact that the underlying paint is most likely lead0based, and that the wood siding may have rot or other structural issues that need to be addressed before it can be recoated.

On the flip side, the mechanicals in older homes (lights, heating systems, sump pump, etc.) tend to be better built and last longer.

Outdoor space

One of the great things about older homes is that they usually come with mature trees and bushes already in place. Buyers of new homes may have to wait years for ornamental trees, fruit trees, roses, ferns, cacti and other long-term vegetation to fill in a yard, create shade, provide privacy, and develop into an inviting outdoor space. However, maybe you’re one of the many homeowners who prefer the wide-open, low-maintenance benefits of a lightly planted yard.

Car considerations

Like it or not, most of us are extremely dependent on our cars for daily transportation. And here again, you’ll find a big difference between newer and older homes. Newer homes almost always feature ample off-street parking: usually a two-car garage and a wide driveway. An older home, depending on just how old it is, may not offer a garage—and if it does, there’s often only enough space for one car. For people who don’t feel comfortable leaving their car on the street, this alone can be a determining factor.

Finalizing your decision

While the differences between older and newer homes are striking, there’s certainly no right or wrong answer. It is a matter of personal taste, and what is available in your desired area. To quickly determine which direction your taste trends, use the information above to make a list of your most desired features, then categorize those according to the type of house in which they’re most likely to be found. The results can often be telling.

Regional Market Update March 2019

How to Get Started in Real Estate Investing

Investing in real estate is one of the world’s most venerable pathways to building wealth. When properly managed, income from renting or real estate investment trusts can provide you with the financial security to plan out the rest of your life. The conclusion is easy to envision, but knowing where to begin can be overwhelming, particularly for anyone who has never previously owned a home.

At Windermere our goal is always to improve and support our communities, so we’ve put together a few key things to keep in mind as you enter the world of real estate investment.

Know the right type of investment for you

Investing in real estate needn’t commit you to being a landlord. A Real Estate Investment Trust (REIT) is a low-maintenance way to get involved in real estate with next to none of the day-to-day monitoring required of direct property management. REITs are trusts that typically own multiple properties, and investors may purchase shares within the REIT. Typically, as the value of the property rises, so too do the values of your shares. If you’d like to dip a toe into real estate investing before diving in fully, a REIT is a great place to start.

Start with your own home

Owning the roof over your head is a basic step towards investing success. Even better, when you plan to live in the home you’re buying (rather than renting it out), you will likely benefit from lower mortgage rates and a cheaper down payment. The reasoning is straightforward – lenders see a loan to people purchasing the home they live in as an investment in people highly committed to the property.

Once you’ve owned your own house for a few years, you can look to purchase a new home to move into. By purchasing the new home with the intent to move in, you’ll be eligible to receive more favorable financing once again. After you’ve secured your new home, your first home is primed to be transformed into a rental property, and you can continue to see a return on your investment. If you’re seeking further support with buying a first, second, or third home, our website and our agents are full of information.

Cast a wide net

The best investment opportunity isn’t always going to be right underneath your nose. While there are logistical benefits to focusing locally with your investment, you may miss more profitable opportunities in another burgeoning market. Real estate is a long game, and patience tends to be rewarded. There’s no cause to rush a decision of this magnitude, so investigating other states and regions to find the property that best fits your situation is a process worth considering.

10 Tips to Minimize Stress When Selling Your Home

When I was growing up, my family must have moved a dozen times. After the first few moves, we had it down to a science: timed out, scheduled, down to the last box. Despite our best efforts, plans would change, move-out and move-in days would shift, and the experience would stress the entire family out. Despite the stress, we always managed to settle in our new home and sell our old one before the start of school.

With a lot of planning and scheduling, you can minimize the stress of selling your house and moving. Here are some tips:

Plan Ahead

Know when you want to be moved out and into your new home and have a backup plan in case it falls through. Before you sell your home, familiarize yourself with local and state laws about selling a home so you’re not caught by surprise if you forget something important.

Lists and schedules are going to be your new best friend through the process. Have a timetable for when you want to sell your house when you have appraisers, realtors, movers, etc. over. Also, keep one for when your things need to be packed and when you need to be moved into the new place. I suggest keeping it on an Excel sheet so you can easily update it as the timeline changes (and it will – stuff happens).

Use Resources

First time selling a house? Check out some great resources on what you need to know. US News has excellent, step-by-step guides on what you need to know to sell. Appraisers and realtors can also be good resources, and since you’ll be working with them through the process, be sure to ask them questions or have them point you to resources.

Appraisal

Have your house appraised before you sell so you know your budget for your new home. This will help you look for an affordable home that meets your family’s needs. It will also help you maximize the amount you can receive for your old home. You can also learn useful information from an appraisal, such as which repairs need to be made, if any.

Repairs

Does your house need repairs before you move? If so, figure out whether you’ll be covering them, or whether your buyers will (this will be a part of price negotiations, so factor it in with your home budget). Will you need to make repairs in your new house, or will that be covered? Either way, make sure you know which repairs need to be made – and either be upfront with buyers about them or make them before you sell.

Prepare to Move

If you’re moving to a new town or a new state, you need to prepare more than just a new home. Research doctors and dentists, places to eat, and what to do for fun. If you have school-aged children, look at the local school district or private school options – not only to learn how to enroll your kids, but also to get a feel for the school culture, see what extracurricular activities your kids can do, what standards/learning methods your kids’ new school will implement, etc.

Packing

Think: how soon are you moving, what will you need to use before you move, what can get boxed and what needs to stay out? The sooner you’re moving out, the sooner you need to pack, but if you have time, just take a day per weekend to organize a room, pack what you want to take and arrange to donate what you want to get rid of.

Downsizing

Moves are a great time to purge old, unwanted and unused stuff from your home. Sometimes, it’s necessary if you’re moving into a smaller space. Either way, as you pack each room, think about whether you use what you’re packing to take with you. If you do, pack it to go. If not, put it in a separate box to go to your local donations place. You can also call some organizations to have your unwanted things picked up, no hassle.

If You Have Kids

Moving with kids can be extra stressful. Be sure to include them in the process. This is a wonderful opportunity to teach younger children about moving and prepare them for the changes it brings. Older children can help out with responsibilities, like packing their room or researching their new town.

Your New Place

Moving into a new place takes some planning as well. Once you’ve bought your new home or condo, design at least a basic outline for where your stuff will be set up. Make necessary repairs and decorate (painting, for example) before you unpack. Ideally, you should have some time to do these things before, but if you don’t, don’t be in a hurry to unpack everything – it can be a hassle to paint if you have all your furniture and bookshelves up!

Staying In Touch and Making New Friends

Finally, moving can mean good-byes with family and/or friends. Social media is a great way to keep in touch with people after you’ve moved, but distance can still weaken these old relationships. Make some time to call or message your old friends to keep in touch. Pair that work with a concerted effort to meet new people. See what hobbies or groups are in your new area and start there. It doesn’t seem like a lot, but it can make your new house a home and make your new town a community you can enjoy.

Patrick Bailey is a professional writer mainly in the fields of mental health, addiction, and living in recovery. Patrick is currently a writer for Mountain Springs Recovery as well as on his own blog.

Open Your Home With the Right Tone and a Welcome Mat

Right before the guests ring the doorbell or give the front door an old-fashioned knock, they step on your welcome mat. This mat serves two purposes: catching debris and adding style. Here are some ideas for how to give this entry detail a refresh.

Welcome Mat 1: Caela McKeever, original photo on Houzz

Say Hello

A lettered mat can help you say exactly what you want to say when someone comes to your door. Obviously, nothing says hello more than the word “hello.”

The simple greeting might also draw visitors’ eyes to the ground and remind them to take off their shoes before they step inside.

Coordinate Colors

If you have a colorful front door, use that as doormat inspiration. If your door lacks color, maybe it’s time to paint it.

Door paint: Scarlet Ribbons, Dulux

Welcome Mat 2: Zack | de Vito Architecture + Construction

The whole mat doesn’t need to match the door. This striped mat draws on other colors found on the home’s exterior.

Welcome Mat 3: Rustic Porch, original photo

Think Outside the Rectangle

Many front doors feature rectangular doormats, but other options exist. The semicircle mat in the photo works nicely with the rustic rockers, porch swing, and shutters.

Welcome Mat 4: Garrison Hullinger Interior Design Inc.

Roll Out a Rug

A big, bold rug in front of the door adds color and life to this home’s entry, designed by Garrison Hullinger.

A large porch rug can also make the space feel like another room of the house. If you add a few chairs, people can stop, relax, and enjoy the outdoors. Plus, more rug means more chances for it to pick up any water or dirt from the shoes of incoming guests.

Welcome Mat 5: Seattle Staged to Sell and Design LLC

Keep It Natural

If the entry is already bursting with details, such as eye-catching hardware and light fixtures, a neutral mat will help keep the attention on them. Natural doesn’t have to mean boring.

Welcome Mat 6: Grandin Road, original photo on Houzz

Personalize the Space

This contemporary monogrammed mat is hard to miss. “Don’t be afraid to choose a doormat with personality, says Kate Beebe of Grandin Road. “Work some wit and whimsy into your entrance, and choose something that will put a smile on your guests’ faces.”

She also recommends picking a mat that covers at least three-quarters of the entrance’s width and allows the door to open easily.

Change With the Seasons

While you are changing the front porch decor, swap a plain doormat for a festive option.After the holidays, clean off your seasonal doormat and store it until the following year.

Make It Feel Like Home

Doormat options are pretty much endless, so it shouldn’t be hard to find one that works for you.

The Q4 2018 Western Washington Gardner Report

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to me.

ECONOMIC OVERVIEW

The Washington State economy continues to add jobs at an above-average rate, though the pace of growth is starting to slow as the business cycle matures. Over the past 12 months, the state added 96,600 new jobs, representing an annual growth rate of 2.9% — well above the national rate of 1.7%. Private sector employment gains continue to be quite strong, increasing at an annual rate of 3.6%. Public sector employment was down 0.3%. The strongest growth sectors were Real Estate Brokerage and Leasing (+11.4%), Employment Services (+10.3%), and Residential Construction (+10.2%). During fourth quarter, the state’s unemployment rate was 4.3%, down from 4.7% a year ago.

My latest economic forecast suggests that statewide job growth in 2019 will still be positive but is expected to slow. We should see an additional 83,480 new jobs, which would be a year-over-year increase of 2.4%.

HOME SALES ACTIVITY

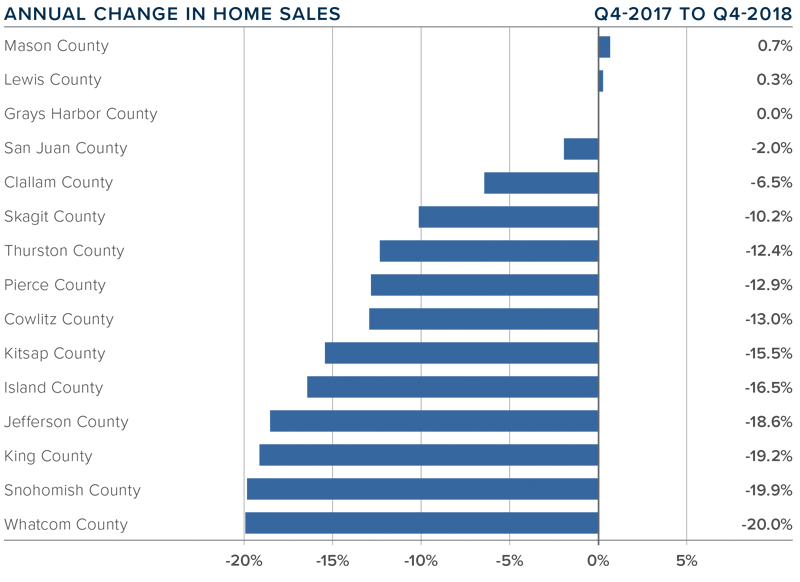

- There were 17,353 home sales during the fourth quarter of 2018. Year-over-year sales growth started to slow in the third quarter and this trend continued through the end of the year. Sales were down 16% compared to the fourth quarter of 2017.

- The slowdown in home sales was mainly a function of increasing listing activity, which was up 38.8% compared to the fourth quarter of 2017 (continuing a trend that started earlier in the year). Almost all of the increases in listings were in King and Snohomish Counties. There were more modest increases in Pierce, Thurston, Kitsap, Skagit, and Island Counties. Listing activity was down across the balance of the region.

- Only two counties—Mason and Lewis—saw sales rise compared to the fourth quarter of 2017, with the balance of the region seeing lower levels of sales activity.

- We saw the traditional drop in listings in the fourth quarter compared to the third quarter, but I fully anticipate that we will see another jump in listings when the spring market hits. The big question will be to what degree listings will rise.

HOME PRICES

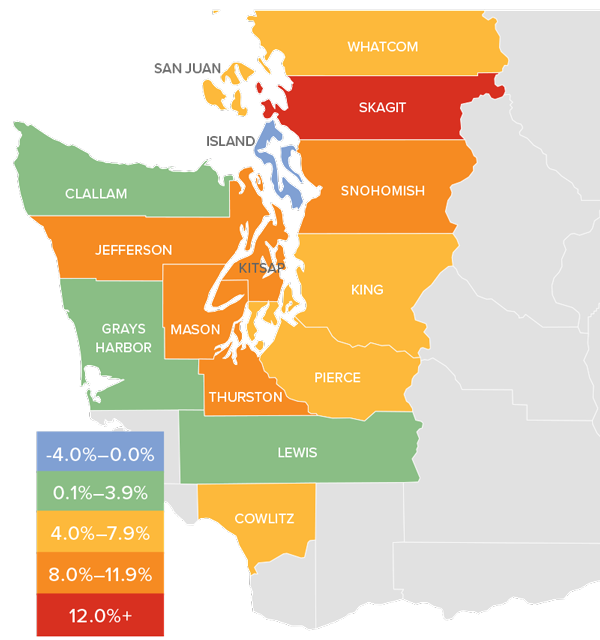

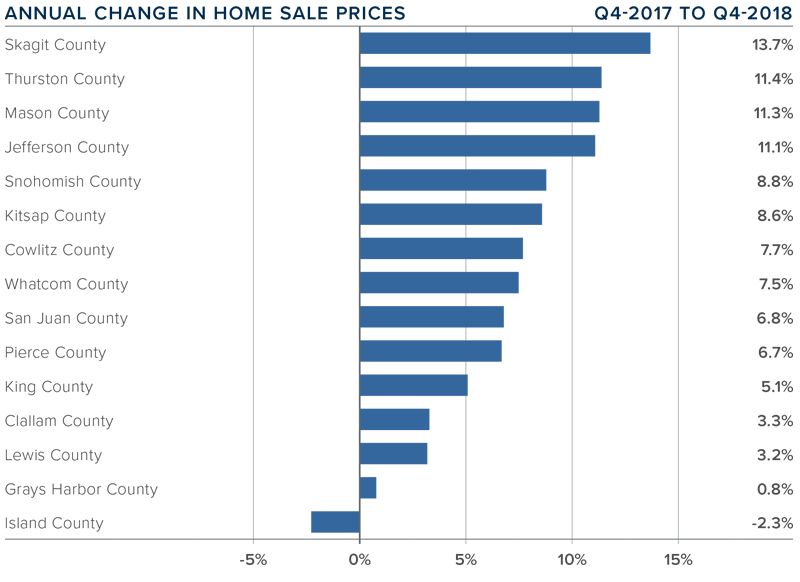

- With greater choice, home price growth in Western Washington continued to slow in fourth quarter, with a year-over-year increaseof 5% to $486,667. Notably, prices were down 3.3% compared to the thirdquarter of 2018.

- Home prices, although higher than a year ago, continue to slow. As mentioned earlier, we have seen significant increases in inventory and this will slow down price gains. I maintain my belief that this is a good thing, as the pace at which home prices were rising was unsustainable.

- When compared to the same period a year ago, price growth was strongest in Skagit County, where home prices were up 13.7%. Three other counties experienced double-digit price increases.

- Price growth has been moderating for the past two quarters and I believe that we have reached a price ceiling in many markets. I would not be surprised to see further drops in prices across the region in the first half of 2019, but they should start to resume their upward trend in the second half of the year.

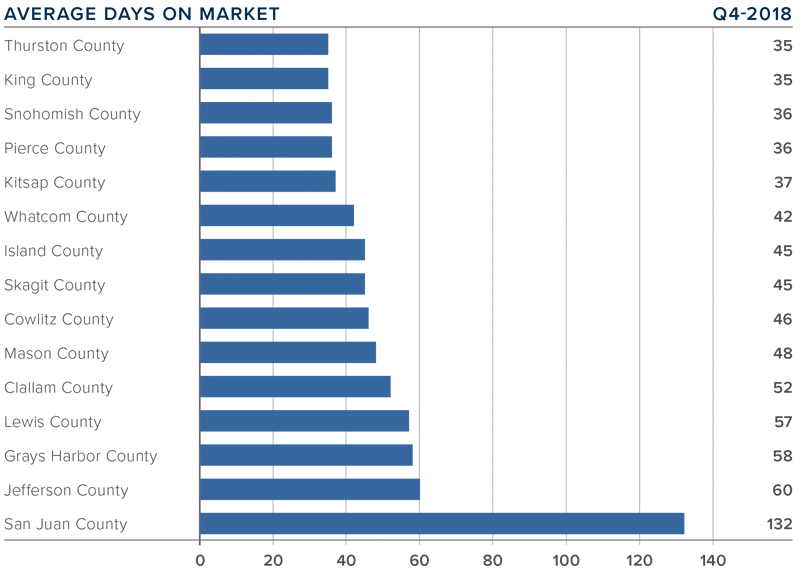

DAYS ON MARKET

- The average number of days it took to sell a home dropped three days compared to the same quarter of 2017.

- Thurston County joined King County as the tightest markets in Western Washington, with homes taking an average of 35 days to sell. There were eight counties that saw the length of time it took to sell a home drop compared to the same period a year ago. Market time rose in five counties and was unchanged in two.

- Across the entire region, it took an average of 51 days to sell a home in the fourth quarter of 2018. This is down from 54 days in the fourth quarter of 2017 but up by 12 days when compared to the third quarter of 2018.

- I suggested in the third quarter Gardner Report that we should be prepared for days on market to increase, and that has proven to be accurate. I expect this trend will continue, but this is typical of a regional market that is moving back to becoming balanced.

CONCLUSIONS

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am continuing to move the needle toward buyers as price growth moderates and listing inventory continues to rise.

2019 will be the year that we get closer to having a more balanced housing market. Buyer and seller psychology will continue to be significant factors as home sellers remain optimistic about the value of their home, while buyers feel significantly less pressure to buy. Look for the first half of 2019 to be fairly slow as buyers sit on the sidelines waiting for price stability, but then I do expect to see a more buoyant second half of the year.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Tips for Moving Into a Smaller Home as a Senior

By Michael Longsdon

For many seniors, there comes a time when the expense and upkeep of a big home no longer seem realistic. All of your kids have moved out, and suddenly, your multi-bedroom house feels excessively large and empty. Plus, it may be difficult to keep up with mortgage payments if you’re expecting a lower income during retirement. Whether downsizing is a financial necessity or an emotional decision, here’s how to tackle the process without getting overwhelmed.

Do Online Research

Before you start looking at houses in person, narrow down your options by doing some research online. Search the local housing market on sites such as Redfin to get a feel for house prices in your desired area. For example, homes in Seattle, Washington have sold for an average of $685,000during the past month. Explore listings in your preferred size range and location so you can come up with a realistic budget for your new home.

Think far ahead as you look at homes, considering the possibility that the needs of you and your spouse may change over time. One-story homes can be much more accessible for you and your friends down the line. You should also take time to research the neighborhood and pay attention to the house’s proximity to grocery stores, leisure centers, and public transportation.

Plan for Your Storage Needs

If you’re moving to an apartment or condo, you may not have the attic, basement, or even the closet space that you’re used to. Look for a nearby for an affordable self-storage unit so you aren’t left crowding boxes and furniture into your new home. Some simple online research can help you find the best deals in your area. In the last 180 days, for instance, self-storage units in Seattle, Washington cost an average of $88.45 per month.

Go Through Your Possessions Methodically

One of the hardest parts about downsizing is getting rid of things you’ve had for decades. Apartment Guide recommends looking at pictures of clutter-free rooms in magazines for inspiration before starting your own purge. This will mentally prepare you for getting rid of all the stuff you don’t need cluttering up your new, smaller space.

As you declutter, go room by room and sort items into no more than five piles: keep, donate, sell, gift, and throw away. Don’t be afraid to let go of things that are useful but not particularly necessary in your own life. Likewise, don’t keep things out of obligation or feelings of guilt. While you’re cutting the clutter, keep a floor plan of your new home nearby so you can plan out your rooms and ensure your furniture will fit. If you’re worried about accurately measuring your space, you can hire a professional to help you out.

Pack Like a Pro

Protect your items during your move and make them easier to unpack later by trying out some expert packing tips. For example, socks make great padding for glasses and mugs, while oven mitts are perfect for transporting knives a little more safely. Secure entire desk drawers and kitchen storage trays with plastic wrap for much faster unpacking later. Also, keep your clothing on hangers and simply slip a garbage bag over them for protection. Remember to pack an essentials box of everything you need during your first day and night in your new house.

Follow a Moving Checklist

There is a lot to remember to do before moving day. For example, you need to update your mailing address with the post office, find a new doctor, and transfer your utilities. Follow a moving checklist (or hire a senior move manager for around $316 per day) to avoid forgetting important tasks. One of your moving tasks should involve researching moving companies at least two months before your move. This gives you plenty of time to find the help you need within your budget. Learn about how to spot rogue moving companies so you can avoid being scammed, especially if you’re moving long distance.

Moving is exhausting for anyone. But moving into a smaller home can be especially emotional as you say goodbye to personal objects that have surrounded you for much of your life. For this reason, it’s important to take things slow while you sort through your possessions and search for the perfect place to spend your golden years.

Mr. Longsdon provides advice to seniors on downsizing and aging in place and can discuss concerns like tackling home accessibility modifications, how to find a great contractor, the benefits of aging in place, and more.

Investing In a Green Home Will Pay Dividends In 2019

As we step forward into 2019, eco-friendly “green homes” are more popular than ever. Upgrading your home’s sustainability improves quality of life for those residing in it, but it is also a savvy long-term investment. As green homes become more popular, properties boasting sustainable features have become increasingly desirable targets for homebuyers. Whether designing a new home from scratch or preparing your current home for sale, accentuating a house with environmentally-friendly features can pay big dividends for everyone.

While the added value depends on the location of the home, its age, and whether it’s certified or not, three separate studies all found that newly constructed, Energy Star, or LEED-certified homes typically sell for about nine percent more than comparable, non-certified new homes. Plus, one of those studies discovered that existing homes retrofitted with green technologies, and certified as such, can command a whopping 30-percent sales-price boost.

There are dozens of eco-friendly features that can provide extra value for you as a seller. To name a few:

Cool roof

Cool roofs keep the houses they’re covering as much as 50 to 60 degrees cooler by reflecting the heat of the sun away from the interior, allowing the occupants to stay cooler and save on air-conditioning costs. The most common form is metal roofing. Other options include roof membranes and reflective asphalt shingles.

Fuel cells

Fuel cells may soon offer an all-new source of electricity that would allow you to completely disconnect your home from all other sources of electricity. About the size of a dishwasher, a fuel cell connects to your home’s natural gas line and electrochemically converts methane to electricity. One unit would pack more than enough energy to power your whole home.

For many years, fuel cells have been far too expensive or unreliable. But as technology has improved, so too has reliability. Companies like Home Power Solutions and Redbox Power Systems have increased the reliability of these fuel sources while reducing their size. Much like we’ve seen computers and cell phones shrink in size while improving reliability and power, fuel cells continue to be refined.

Wind turbine

A wind turbine (essentially a propeller spinning atop an 80- to 100-foot pole) collects kinetic energy from the wind and converts it to electricity for your home. And according to the Department of Energy, a small version can slash your electrical bill by 50 to 90 percent.

But before you get too excited, you need to know that the zoning laws in most urban areas don’t allow wind turbines. They’re too tall. The best prospects for this technology are homes located on at least an acre of land, well outside the city limits.

Green roof

Another way to keep the interior of your house cooler—and save on air-conditioning costs—is to replace your traditional roof with a layer of vegetation (typically hardy groundcovers). This is more expensive than a cool roof and requires regular maintenance, but young, environmentally conscious homeowners are very attracted to the concept.

Hybrid heating

Combining a heat pump with a standard furnace to create what’s known as a “hybrid heating system” can save you somewhere between 15 and 35 percent on your heating and cooling bills.

Unlike a gas or oil furnace, a heat pump doesn’t use any fuel. Instead, the coils inside the unit absorb whatever heat exists naturally in the outside air, and distributes it via the same ductwork used by your furnace. When the outside air temperature gets too cold for the heat pump to work, the system switches over to your traditional furnace.

Geothermal heating

Geothermal heating units are like heat pumps, except instead of absorbing heat from the outside air, they absorb the heat in the soil next to your house via coils buried in the ground. The coils can be buried horizontally or, if you don’t have a wide enough yard, they can be buried vertically. While the installation price of a geothermal system can be several times that of a hybrid, air-sourced system, the cost savings on your energy bills can cover the installation costs in five to 10 years.

Solar power

Solar panels capture light energy from the sun and convert it directly into electricity. Similarly to wind turbines, your geographical location may determine the feasibility of these installments. Even on cloudy days, however, solar panels typically produce 10-25% of their maximum energy output. For decades, you may have seen these panels sitting on sunny rooftops all across America. But it’s only recently that this energy-saving option has become truly affordable.

In 2010, installing a solar system on a typical mid-sized house would have set the homeowner back $30,000. But as of December 2018, the average cost after tax credits for solar panel installation was just $13,188! Plus, some companies are now offering to rent solar panels to homeowners (the company retains ownership of the panels and sells the homeowner access to the power at roughly 10 to 15 percent less than they would pay their local utility).

Solar water heaters

Rooftop solar panels can also be used to heat your home’s water. The Environmental Protection Agency estimates that the average homeowner who makes this switch should see their water bills shrink by 50 to 80 percent.

Tax credits/rebates

Many of the innovative solutions summarized above come with big price tags attached. However, federal, state and local rebates/tax credits can often slash those expenses by as much as 50 percent. So before ruling any of these ideas out, take some time to see which incentives you may qualify for at dsireusa.org and the “tax incentives” pages at Energy.Gov.

Regardless of which option you choose, these technologies will help to conserve valuable resources and reduce your monthly utility expenses. Just as importantly, they will also add resale value that you can leverage whenever you decide it’s time to sell and move on to a new home.

2019 Economic and Housing Forecast

What a year it has been for both the U.S. economy and the national housing market. After several years of above-average economic and home price growth, 2018 marked the start of a slowdown in the residential real estate market. As the year comes to a close, it’s time for me to dust off my crystal ball to see what we can expect in 2019.

The U.S. Economy

Despite the turbulence that the ongoing trade wars with China are causing, I still expect the U.S. economy to have one more year of relatively solid growth before we likely enter a recession in 2020. Yes, it’s the dreaded “R” word, but before you panic, there are some things to bear in mind.

Firstly, any cyclical downturn will not be driven by housing. Although it is almost impossible to predict exactly what will be the “straw that breaks the camel’s back”, I believe it will likely be caused by one of the following three things: an ongoing trade war, the Federal Reserve raising interest rates too quickly, or excessive corporate debt levels. That said, we still have another year of solid growth ahead of us, so I think it’s more important to focus on 2019 for now.

The U.S. Housing Market

Existing Home Sales

This paper is being written well before the year-end numbers come out, but I expect 2018 home sales will be about 3.5% lower than the prior year. Sales started to slow last spring as we breached affordability limits and more homes came on the market. In 2019, I anticipate that home sales will rebound modestly and rise by 1.9% to a little over 5.4 million units.

Existing Home Prices

We will likely end 2018 with a median home price of about $260,000 – up 5.4% from 2017. In 2019 I expect prices to continue rising, but at a slower rate as we move toward a more balanced housing market. I’m forecasting the median home price to increase by 4.4% as rising mortgage rates continue to act as a headwind to home price growth.

New Home Sales

In a somewhat similar manner to existing home sales, new home sales started to slow in the spring of 2018, but the overall trend has been positive since 2011. I expect that to continue in 2019 with sales increasing by 6.9% to 695,000 units – the highest level seen since 2007.

That being said, the level of new construction remains well below the long-term average. Builders continue to struggle with land, labor, and material costs, and this is an issue that is not likely to be solved in 2019. Furthermore, these constraints are forcing developers to primarily build higher-priced homes, which does little to meet the substantial demand by first-time buyers.

Mortgage Rates

In last year’s forecast, I suggested that 5% interest rates would be a 2019 story, not a 2018 story. This prediction has proven accurate with the average 30-year conforming rates measured at 4.87% in November, and highly unlikely to breach the 5% barrier before the end of the year.

In 2019, I expect interest rates to continue trending higher, but we may see periods of modest contraction or levelling. We will likely end the year with the 30-year fixed rate at around 5.7%, which means that 6% interest rates are more apt to be a 2020 story.

I also believe that non-conforming (or jumbo) rates will remain remarkably competitive. Banks appear to be comfortable with the risk and ultimately, the return, that this product offers, so expect jumbo loan yields to track conforming loans quite closely.

Conclusions

There are still voices out there that seem to suggest the housing market is headed for calamity and that another housing bubble is forming, or in some cases, is already deflating. In all the data that I review, I just don’t see this happening. Credit quality for new mortgage holders remains very high and the median down payment (as a percentage of home price) is at its highest level since 2004.

That is not to say that there aren’t several markets around the country that are overpriced, but just because a market is overvalued, does not mean that a bubble is in place. It simply means that forward price growth in these markets will be lower to allow income levels to rise sufficiently.

Finally, if there is a big story for 2019, I believe it will be the ongoing resurgence of first-time buyers. While these buyers face challenges regarding student debt and the ability to save for a down payment, they are definitely on the comeback and likely to purchase more homes next year than any other buyer demographic.

Originally published on Inman News.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link